First-time home buyers feel the squeeze

High interest rates, high home prices and availability all factors

Add another factor into the challenge of attracting workers and families to North Dakota: the lack of affordable, modern, quality homes.

With home prices at historic highs and interest rates double what they were a year before, first-time home buyers searching for a place to call their own are in the grip of a squeeze that shows no signs of loosening any time soon.

With those high costs, and the additional increases in overall inflation, the number of homes on the market affordable for lower- and middle-income buyers has dwindled across the state, from large cities like Bismarck to rural towns like Harvey.

Average North Dakota house sales prices were at $283,000 by the end of 2021, up from $198,000 in 2012, according to the most recent data compiled by the North Dakota Housing Finance Agency [NDHFA], but median sales prices in most of the main cities range higher.

U.S. Federal Housing Finance Agency estimates using both appraisal value and sales prices show prices peaking in the fourth quarter of last year with no indications they’re falling off yet.

Brandon Dettlaff, homeownership division director at the NDHFA, doesn’t see many houses available compared to the need below $350,000. When they do come on the market they go quickly.

“We’ve seen a historic rise in prices, but people’s wages haven’t gone up the same amount,” Dettlaff said. “So your buying power isn’t the same. And then you double interest rates, and what do you do?”

At the same time as inflation surged, income dropped, the most recent US Census Bureau data shows. At the end of 2021, median household income in North Dakota stood at nearly $69,000, a slight drop from around $70,000 in 2019.

Competitive market

Those looking for houses in an affordable range face stiff competition.

For Kari Richey, who purchased a home in Bismarck under $200,000 in December, it was a long and sometimes daunting process.

“It was a long year of searching, and the ones that would come available … would just go so quickly,” Richey said. “So when I did find my house I had to move very quickly on it. It was a challenge.”

Inflation itself is taking a major bite out of lower- and middle-income purchasing power and increases the cost of maintaining a home.

Since April 2021, prices for appliances, cable TV, furniture and hardware, household tools and equipment, natural gas, and electricity have all risen, with the latter three increasing by over 20 percent nationwide.

Average groceries prices have also increased by around 20 percent since April 2021. Factor in childcare - which ranges from around $660 to $840 per child on average - and many young families looking to buy a house can’t afford these accumulating costs.

Affordability across the country is now worse than during the housing bubble of 2008, according to data recently released by the Atlanta Fed’s Housing and Affordability Monitor. By December 2022, the study indicated that the average household would need to spend 42.9 percent of its income to pay for a median-priced home.

“Affordability across the state is a problem,” Dettlaff said of the situation here. “There’s not that supply so prices are going to stay elevated. I fear that it’s probably going to stay that way for a few years.”

Inventory will continue to remain tight since those who bought homes when interest rates were low are less likely to give that up for a new home with much higher rates, he said.

Feeling the pinch

The realization is starting to dawn on many first-time home buyers that they may not be able to afford the kind of home now that they would have just two years ago, due to the rise in interest rates.

Since more people are pushed into the lower end of the market, it also increases the competition for homes in that range, said Bismarck-area real estate agent Desi Ottmar.

“Those are the people who are getting pinched,” Ottmar said. “Some people are dropping out.”

Ottmar told a story of a recent client who had qualified for a home in the $250,000 range, then went forward with starting the purchase on a $200,000 home. They later backed out when they juggled the purchase numbers with their finances.

For those looking for a home in a rural community like the town of Harvey, options are often limited. Only three homes within Harvey city limits are currently listed while two more sit within shouting distance.

Spencer Marchand, economic development director for the city of Harvey and a member of the local school board, said the situation has impacted the area’s ability to recruit and retrain workers.

“We’ve had plenty of trouble hiring teachers because of the situation,” Marchand said, indicating that the school system there is currently three teachers short.

“An alarming statistic is that less than 13 percent of the housing stock in the area has been built in the past 20 years,” he added. “There’s a lack of modern, in demand real estate that people desire.”

That’s a theme across the state in areas that missed out on oil boom development.

It has also become a fact of life that finding developers and contractors to build new houses in some communities, whether rural or urban, has become more difficult. Prices for materials and labor have soared. Finding construction workers is problematic.

Development woes

David Klein, Jamestown-based executive director of Great Plains Housing Authority, said both new development and redevelopment have become complex and expensive.

Talks with developers about building on vacant lots or tearing down an old home and rebuilding become fraught with cost concerns. Costs of a teardown and environmental cleanup can reach $1 million or more, he said.

New greenfield development is also difficult since farmers would rather sell off 30 acres before they sell off three, he said.

“That makes it hard to encourage development,” Klein said. “You’ve got to buy so much [land] and as you’re bringing that in you’ve got to put in a substantial amount of infrastructure.”

With the state estimated to add around 10,000 people by 2025, the NDHFA projects that 9,285 to 10,280 housing units will need to be added by that date on top of what already exists. A greater influx of people would push that number up.

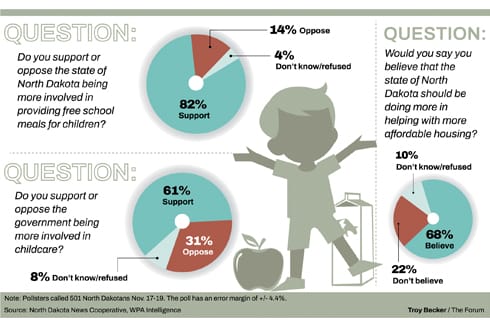

A housing needs assessment conducted by North Dakota State University’s Center for Social Research and NDHFA released last October also projected an increase in the number of lower income households, suggesting a greater need for affordable housing.

“There may be a disconnect between the type of housing that people want and the kind of housing that’s available,” said Nancy Hodur who led the study at the Center for Social Research. “Those moderately priced houses, they flew off the market.”

The study also showed that more affordable homes ranging from $150,000 to $350,000 stayed on the market the least amount of time, pointing again to the strong competition for homes in that range.

Those homes, on average, were 30 to 50 years older than higher priced sales, indicating that they often need upgrades or repairs, potentially further straining the budgets of inflation-stressed households.

John Reiten, a policy advisor to Gov. Doug Burgum who bought a home in Bismarck in early April, said he’d seen around 30 houses during his eight-month hunt.

While he wasn’t under any major pressure to buy a home, he sees the limited supply as a potential issue for the state’s workforce recruitment drive.

“We want to bring people in, right? How do you do that? Lower taxes, good places to live and all these things,” Reiten said. “But if you can’t have homes for them, people will only live in apartments or condos for so long, especially in this area. People need housing.”

Reiten said he believes sellers will start coming down in their asking prices now that the market has changed with buyers burdened by higher interest rates.

One welcoming sign, according to Ottmar, is that sellers are now more willing to offer concessions, something that would have been uncommon just a year before.

Another option for first-time home buyers that’s become popular is a two-for-one buydown, which lowers mortgage rates for the first two years of the loan, before going back up to the current interest rate level, he said.

The North Dakota News Cooperative is a nonprofit news organization providing reliable and independent reporting on issues and events that impact the lives of North Dakotans. The organization increases the public’s access to quality journalism and advances news literacy across the state. For more information about NDNC or to make a charitable contribution, please visit newscoopnd.org. Send comments, suggestions or tips to michael@newscoopnd.org. Follow us on Twitter: https://twitter.com/NDNewsCoop.