Poll: Voters want to tap Legacy Fund, with limits

Taxes, lunches okay; charter schools a firm no

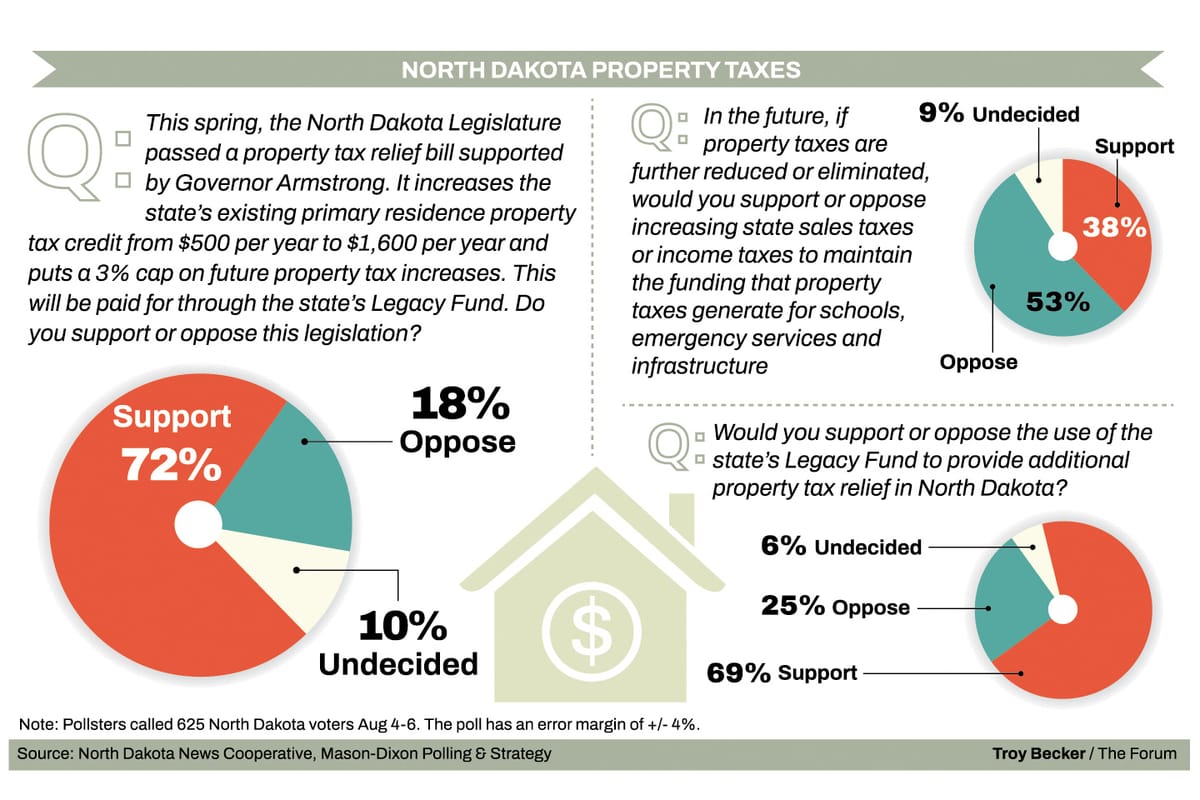

Most North Dakotans support using the state’s Legacy Fund to reduce property taxes even further and to pay for school lunches at public schools, but draw the line at using the sovereign wealth fund to cover private school vouchers, North Dakota Poll data shows.

Of those three, state legislators have only tapped into the Legacy Fund for property tax reductions so far, a decision made during the past legislative session.

According to the latest poll numbers, 69% of respondents support using the Legacy Fund for additional property tax relief, while 25% oppose that action.

Respondents are also firmly behind the idea of local control of property tax rates. A total of 68% said those should remain with local political subdivisions, while 28% said those rates should be decided at the state level.

Former governor Edward Schafer, who played a key role in the creation of the Legacy Fund, said the idea that people want more local control but also want state tax revenue from the Legacy Fund to pay for property tax relief, doesn’t quite match up.

“Putting state money into the deal doesn’t solve the problem,” Schafer said. “It’s got to be that local expenditure and responsibility. If people are saying, I want local control, then you've got to put the responsibility locally. While it is a worthwhile expenditure of the earnings of the Legacy Fund, I think that we're going down the road here of the state taking over local property tax responsibility.”

The value of the Legacy Fund currently stands at $12.5 billion.

A portion of the earnings has gone into the general fund during each biennium since 2019.

Around $686 million was transferred from The Legacy Fund to the general fund for the 2023-2025 period, up from $486 million in the previous biennium, but down from the $871 million distributed during the period before.

Updates were made to definitions of earnings on the Legacy Fund during the last legislative session, with 8% of the 5-year average allowed to be used for the general fund.

Schafer said a concern he has with the continued tapping into the earnings off the Legacy Fund is that commitments keep getting extended, currently to another decade out. If oil revenues that the Legacy Fund taxes drop, those earnings could shrink.

“Instead of each legislative session setting their priorities, they are expending it out and anticipating spending it out on estimated revenues for years and years and years ahead,” Schafer said. “That's not the way it should be set up.”

Yes on school meals, no on charter schools

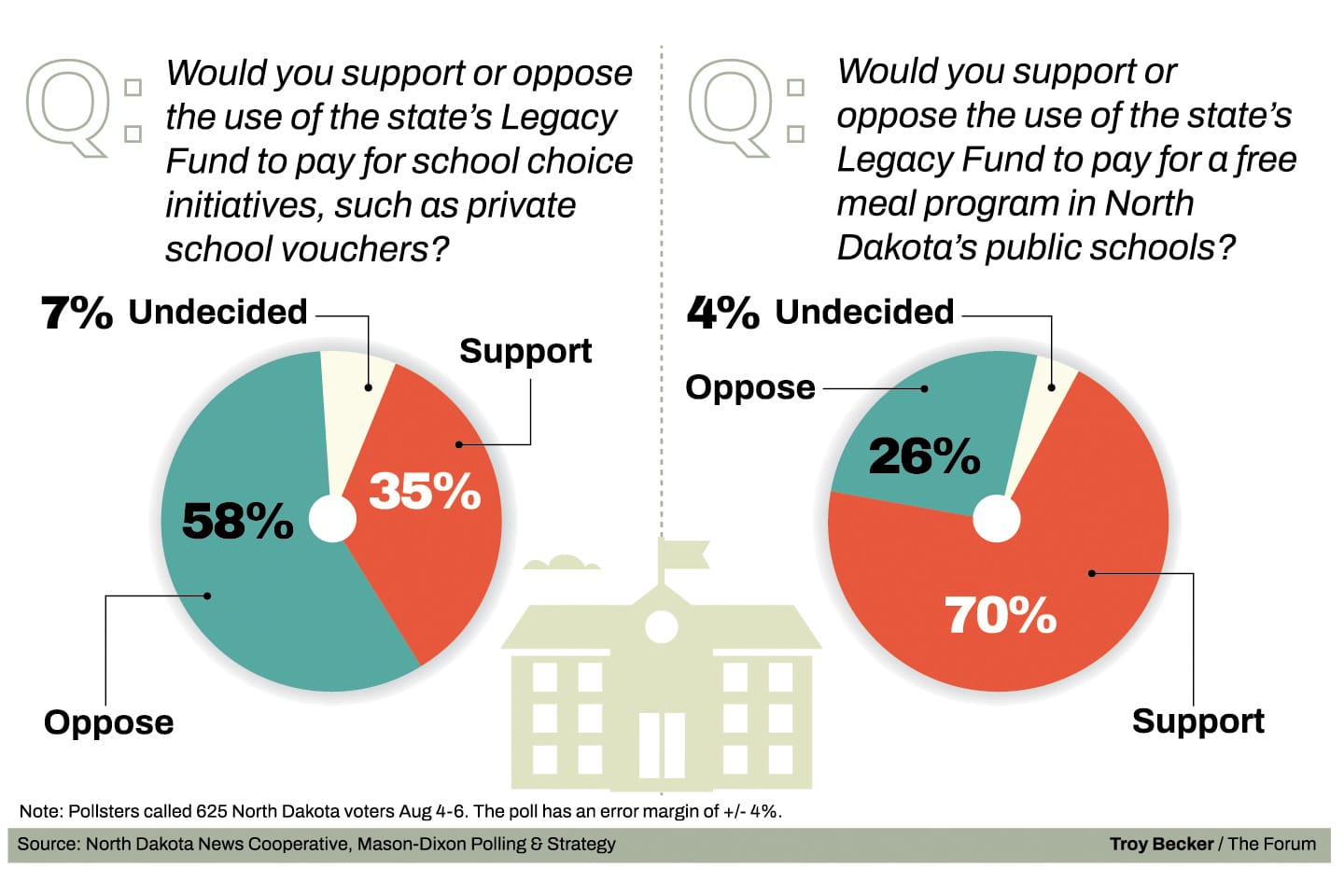

Asked if they would like to see the Legacy Fund tapped for universal school meals, 70% supported that proposal and 26% opposed, according to the poll.

During the past session, House Bill 1553 proposed using around $140 million from the Legacy Fund to cover meals for all K-12 students in the state, but was defeated in the House by a 74-14 vote against the bill.

The state legislature expanded eligibility to cover more, but not all, students later in the session.

“We see again that voters in North Dakota are strongly in favor of that,” said House Minority Leader Zac Ista, D-Grand Forks. “It's one of those things that will take a financial obligation off their plates and help our students and teachers do better in the classroom.”

Ista said on the property tax measure that was passed, he’s happy to see it is so popular.

“Voters are saying, Hey, can we get a break here?” Ista said. “Can we ease that financial pressure of you know, our property tax bill, whether you're paying that once a year or every month with your mortgage payment, people see it going up and up, and they want that relief to come their way.”

Respondents went the opposite direction on using the Legacy Fund for paying for school choice initiatives like private school vouchers: 58% opposed while 35% were in favor.

Strong support for Armstrong property tax plan

Most North Dakotans also back Governor Kelly Armstrong’s property tax relief package, which ended up being the choice of the legislature during the last session.

That plan increased the existing primary residence property tax credit from $500 to $1600 per year, with a 3% cap on future property tax increases.

A total of 72% of the 625 respondents polled supported that plan, while 18% opposed. Support was relatively even across all political affiliations, though 32% of those identifying as Democrats opposed the plan.

Rick Becker, a former state legislator who drove a statewide measure to essentially abolish property taxes in 2024 that was eventually defeated, said dissent likely came from those who didn’t benefit beyond the residence property tax relief.

“One category would be one where they didn’t go far enough, and that would include farmers who got no relief, and small business or businesses, since property tax relief was left to residential only,” Becker said.

No new tax increases

Most respondents, however, drew the line at raising sales or income taxes to generate revenue to pay for schools, emergency services and infrastructure if property taxes are further reduced.

A total of 53% opposed those increases, 38% supported, and 9% were unsure. Republicans had the highest level of support for raising those other taxes, with 43% in favor.

Becker thought the answers could be interpreted several ways and that the numbers are hard to dissect.

One interpretation is “they would rather not have their property taxes go down if it means sales taxes go up,” he said. Another way to look at it would be “the property tax could go down, but we don’t need sales tax since the local (political subdivisions) are already getting too much money,” Becker added.

“This question leaves open, I think, more questions than it has answers,” he said.

The North Dakota Poll, initiated by the North Dakota News Cooperative, was conducted by Mason-Dixon Polling & Strategy, Inc. of Jacksonville, Florida. From August 4 through August 6, 2025, a total of 625 adult regular voters were interviewed statewide by phone. The margin of error is no more than + or - 4%, according to the polling firm.

A total of 155 respondents were in Fargo-Cass County, 155 in eastern North Dakota, 120 in the Bismarck-Mandan region, and another 195 in western North Dakota. Quotas were assigned to reflect voter turnout by county.

Of the 625 respondents, 135 identified as Democrat (22%), 271 as Republican (43%) and 219 as Independent (35%).

The North Dakota News Cooperative is a nonprofit news organization providing reliable and independent reporting on issues and events that impact the lives of North Dakotans. The organization increases the public’s access to quality journalism and advances news literacy across the state. For more information about NDNC or to make a charitable contribution, please visit newscoopnd.org. Send comments, suggestions or tips to michael@newscoopnd.org. Follow us on Twitter: https://twitter.com/NDNewsCoop.